We are excited to announce that we have begun taking appointments for our VITA free tax preparation services. Appointments will take place every Tuesday and Thursday from 3:30pm-6:30pm from Tuesday January 21st through Tuesday April 14th. Appointments are now being accepted through both our Program Specialist, Pam Ciano, as well as our Community Connections Specialist, Kathleen Hernandez.

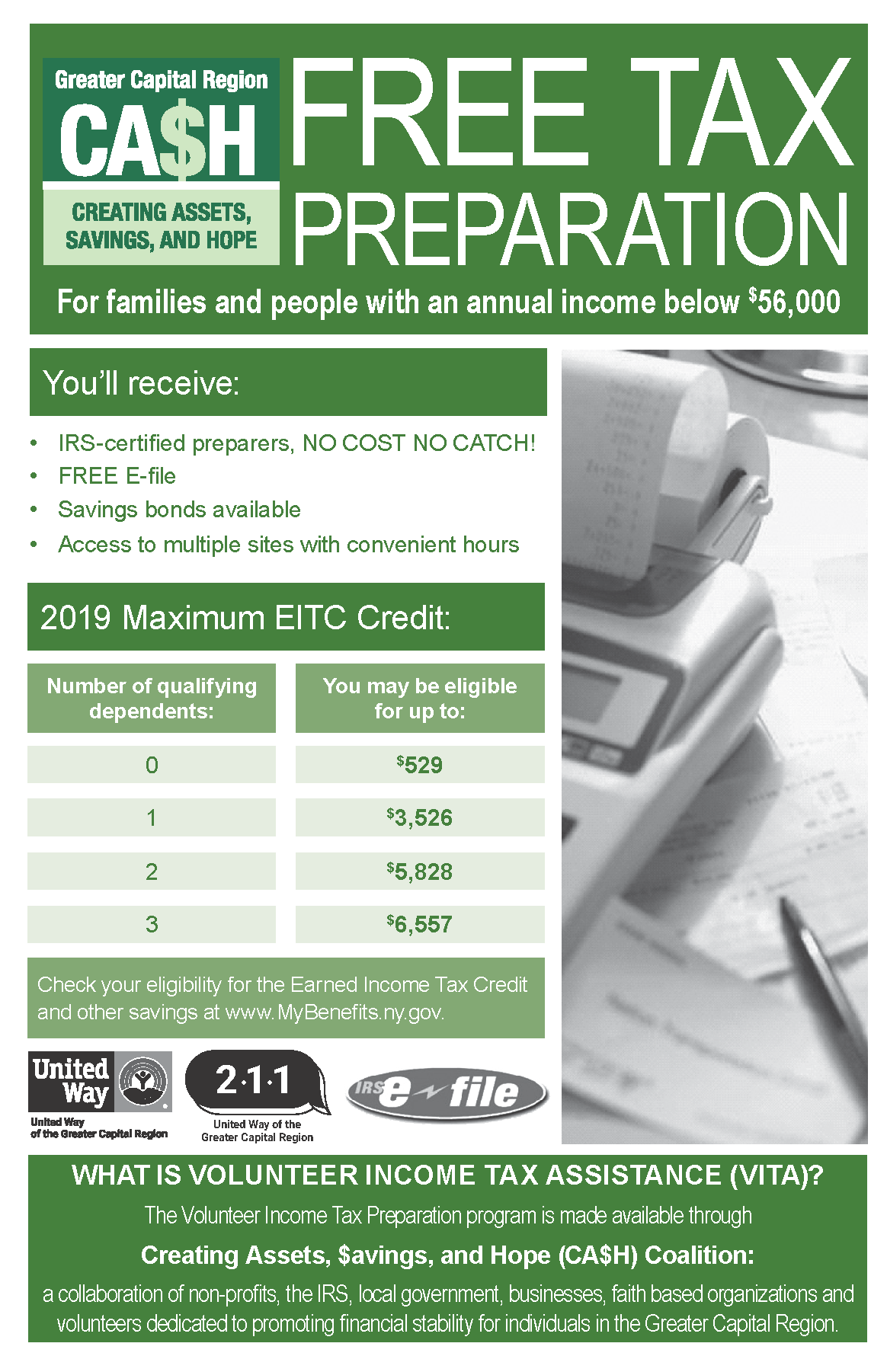

Eligibility criteria:

• HH income of $56,000 or less

Appointments may be made via phone M-F:

• 9am-11am at 518-272-6012 ext. 311, Pam Ciano

• 1:30pm-3:30pm at 518-272-6012 ext. 302, Kathleen Hernandez